If you’ve ever heard someone say something like, “credit cards are always a bad idea,” then you’ve been exposed to a money myth. A money myth is any conventional financial wisdom that turns out to not be true.

Financial decisions are rarely black and white. Like most things in life, there are always shades of gray.

Examine these six money myths with an ambitious eye. Are any of them holding you back from the kind of financial success you deserve? If so, what new belief can you adopt to level up your finances.

A penny saved is a penny earned.

Not true. Do you have money in a savings account rather than invested? Those dollars lose value every day due to inflation (the rise in the cost of goods). During the course of the COVID-19 pandemic, we saw inflation head into pretty wild territory. A dollar today buy a lot less than it once did.

You can’t save your way to wealth. The money you have must begin making money for you.

Do your research, then trust yourself to make a put your dollars to work. Your future self will thank you.

Checking your own credit lowers your score.

Not at all. You have a right to check your own reports and score without any penalty. Checking your credit regularly will help you stay on top of your file, and help you prep for major purchases. You’ll also be more likely to spot errors if they ever crop up.

What confuses people are credit inquiries – times when companies check your credit history to decide whether or not to lend to you.

When you review your own credit profile, there is no inquiry. You have every right to keep an eye on your report. Keep the number of times you apply for new credit to a minimum, and your score will be safe from unnecessary dips.

Canceling old cards will definitely help your credit score.

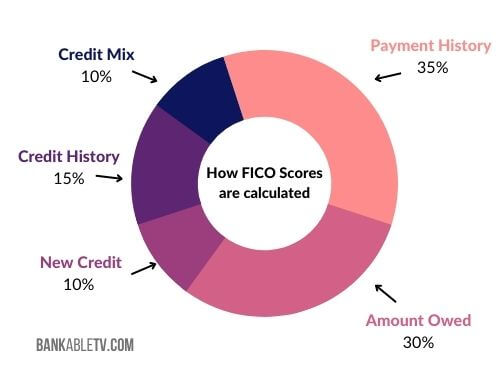

This isn’t always true. Your credit score is a reflection of your complete credit profile. Your payment history, credit utilization, and the age of your accounts all contribute to your FICO score.

If you cancel an old card, you lose the history of the account and lower your total available credit. That could actually end up hurting your scores!

Before deciding to cancel that old card, take a look at your entire credit report. Make sure doing so won’t do more harm than good.

An item’s “sale” price is always a good deal.

No, don’t get caught slipping. A sale price isn’t always what it seems. Some retailers use “sale price visuals” – bold colors, traditional sale signage – to move old inventory that isn’t marked down at all!

Clothing retailers use phrases like “Compare at $ X” to fool consumers into thinking they’re getting more value than they actually are. Be a savvy shopper and do your research. Check unit prices on food items and do your own comparison shopping if you really want the best possible deals.

Credit cards are the devil. Always pay with cash.

This isn’t at all true. If you’re good at controlling your spending and can use them responsibly, credit cards can be great for your monthly financial strategy. The best credit cards offer great rewards and purchase protection that you just don’t get with cash or debit cards.

If you stick to the Credit Card Commandments, you’ll be well on your way to a great credit score and card mastery.

If you’re early in your financial wellness journey or you’re a Baller, make sure you have a strategy in place your making your credit cards work for you, and you’re golden.

Buying a home is always a good investment.

Ah, the American Dream. The desire to own a home is practically baked into our DNA at this point. For some folks, home ownership may be a very smart financial move. For others, renting is a better option.

If your circumstances would make home buying less than optimal right now – you plan to move again in less than five years, for example – do some serious number crunching before you commit to a mortgage. If 2009 taught us anything, the biggest takeaways should be: check the numbers and buy right.

Buying a home doesn’t make you a financial success. Not owning a home doesn’t make you a financial failure. Examine your unique situation, and make a smart money move that serves you.

Wrapping Up

What’s a money myth that you wish would die? What financial beliefs have you kicked to the curb to level up your wealth?

Share your success stories in the comments!

Leave a Reply

Want to join the discussion?Feel free to contribute!