So, you’re ready to get a handle on this credit thing, but don’t know where to start? Bankable’s got you covered.

Your credit is essential to your future. Over the course your lifetime, great credit can save your tens, or even hundreds, of thousands of dollars.

By mastering the credit game, you’ll take charge of your finances. Let’s get started.

What is Credit?

Credit is the ability to receive a good or service immediately by making a promise to pay over time (or at some future date).

It can be in the form of a loan (like a car loan or mortgage), a revolving credit line (like a credit or store card), or some combination of the two.

The savvy use of credit is essential to a successful long-term financial plan. By building and maintaining a strong credit profile, you can save tens of thousands of dollars on major purchases over your lifetime.

Why Is Credit so Important?

Your credit score is used by lenders, insurers, and even employers to evaluate your trustworthiness and employability.

Is it fair? Not really.

Even so, if you want to get ahead and secure your future, mastering the credit game will give you an edge in everything – from job hunting to renting that luxury apartment you love.

Can’t I Just Use Cash (Avoid the Credit Trap)?

This is a common question, and some financial “gurus” advise their readers to live by this.

Cash is King, but credit is Queen.

Having excellent credit makes large purchases (like a home, for example) more accessible to most people. Unless you have a few hundred thousand dollars saved up, buying a home without a mortgage could prove impossible.

Many Americans don’t save that kind of money in a lifetime, let alone over the course of a few years. Credit makes it possible to make strategic purchases that can increase your net worth and improve your life.

A huge savings goal can take several years to achieve. Can you put off your financial goals – buying a home, going to college – for a decade or more while you work to save enough?

If you’re an entrepreneur, credit provides the opportunity to take short-term “loan” to pay for supplies or other essentials.

What is a credit report?

Your credit report is a list that tracks your credit-related activity over several years. The three major credit bureaus each have their own version of this report, and calculate their own score based on the information reported to them.

Your credit report includes identifying information, including

- Your name & age

- Your social security number

- Addresses you’ve used

- Employment information

- Account information

- Payment history, and any liens or judgments against you

What is a Credit Score?

Your credit score is a numeric calculation of your creditworthiness based on the information in your credit report. This number is used by lenders, vendors, and employers to decide whether to do business with you.

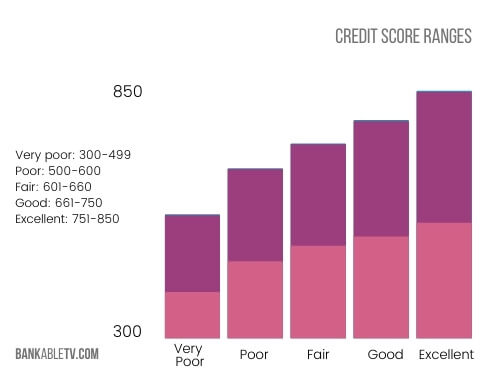

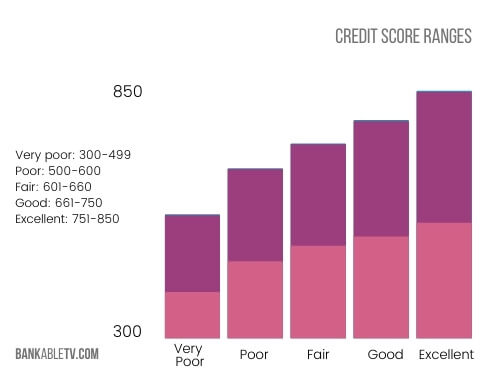

Credit scores range between 300-850.

There are several different credit scoring models, and different industries use different versions when evaluating your credit history. The most well-known are the Fair Isaac Corporation (FICO) and the Vantage score. More on each of these later.

What is a Good Credit Score?

A FICO score of 700+ is considered good, with anything over 750 being considered excellent credit.

Higher scores will qualify you for the best interest rates and most favorable loan terms in almost any borrowing situation.

The average credit score is around 700, with scores tending to increase with age.

Having a very good (or better) credit score signals to lenders that you’re pretty financially responsible, and not likely to default on financial obligations.

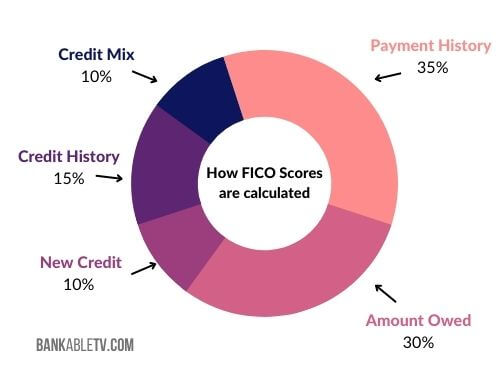

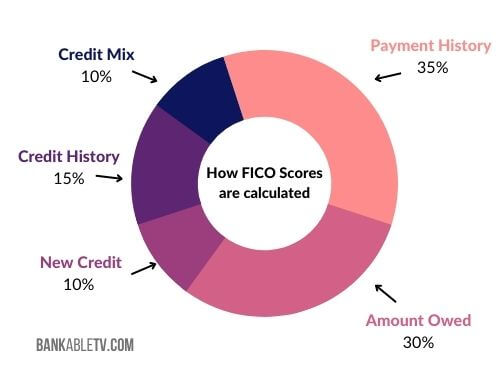

How Your Credit Score is Calculated

Credit scores aren’t as mysterious as most people believe. Each scoring agency has a set of parameters they use to calculate scores. Knowing the key elements that impact a credit score can help you build (or rebuild) a score that works for you.

Your scores are based on the following factors:

- 35% of your score is based on your payment history

- 30% is based on the amount you owe on your credit accounts

- 15% is the length of your credit history (the older your accounts, the better)

- 10% is your credit mix (what type of credit accounts you have)

- 10% is your amount of new credit (how many inquiries you make for new credit, etc.)

Let’s Break Down How Credit Scores are Calculated

The factors that make up your credit score calculation are very specific. Some you can control; others are created by default based on the age of your credit history.

Payment History:

The largest part of your credit score is your payment history. The more consistent you are about paying every bill on time, the better your score.

In addition to avoiding late fees and accruing interest, paying on time will help you build an attractive history that appeals to lenders.

Making just one payment 30 days late can cause your score to drop by more than 50-100 points.

Worse still, the late payment will remain on your credit report for the next seven years. Avoid late payments at all costs, whenever possible.

Amount Owed:

The 2nd largest chunk of your score is the amount owed on your credit obligations. This amount is called your utilization ratio, and the higher the amount of credit you use, the more it hurts your score.

Utilization rate is calculated by:

Total balances owed ÷ total available credit x 100 = Utilization ratio

Let’s say you owe $72,000 on your credit cards.

If you have $100,000 in available credit, your utilization rate is 72%. Not good.

What is a good utilization rate?

Keeping your balances under 30% of your available credit is a good start.

The ideal utilization ratio is under 10% if you want to maximize your credit score.

Length of Credit History:

Lenders love consistency. The longer your credit history, the better it is for your score. There’s little you can do to control this element of your credit score.

Once you open a credit account, never close it. Make small purchases on your oldest accounts to ensure there’s activity to keep them open.

Credit Mix:

Your credit mix accounts for 10% of your credit score. The credit bureaus will look at how many different types of credit accounts you have (revolving credit, charge accounts, installment and mortgage loans, etc.) when evaluating your history.

This won’t have a huge impact on your score, but lenders like to see that you can responsibly manage more than one type of account.

New Credit:

Lenders take into account the amount of newly acquired credit on your reports as well. Lots of new accounts or inquiries (applications for new credit) can signal that you’re facing financial hardship.

Keep your number of new accounts to a minimum, and you’ll maximize your credit score.

The Lowdown on Credit Score Calculations

As you can see, more than 80% of your credit is easy to control.

The foundation of an effective credit strategy is building a flawless payment history and keeping an eye on how much you spend.

How to Check Your Credit Report?

You should check your credit reports at least twice each year.

According to the Federal Trade Commission, about 20% of people have at least one error on their credit reports. Credit reporting inaccuracies can cause your score to drop, so staying on top of the information lenders see could save you money.

Every American is entitled to one free copy of your credit report from each of the credit bureaus each year.

To access your reports, visit AnnualCreditReport.com.