Credit cards are a pretty big part of the money game. Whether you’re a seasoned credit pro, or a total newbie, you’ve probably heard conflicting information about using credit cards.

If you’ve been wondering about the credit card fundamentals, this guide is for you. Read on, and you’ll find 10 essential rules for smart credit card use.

The Credit Card Commandments

1. Pay your bill on time. In full. Every month. Despite what pundits tell you, if you’ve got a little discipline, credit cards (like money) are useful tools. They can act as a VERY short-term loan, giving you the option to keep your capital elsewhere until the due date.

If you rent cars or travel often, they’re essential for fraud protection. Good ones will offer rewards you can use for everything from airline tickets to Amazon purchases.

The key to using them effectively is to never, ever, ever, EVER spend more on a card than you can pay off in a month. If you’ve already done that…

2. Never pay (just) the minimum. Ever. If you absolutely, positively must carry a balance on your credit card, pay down as much of it as possible every month.

Paying the minimum will drag out your payments, and you’ll end up paying tons in interest.

Your money is better spent elsewhere – like buying dividend stocks, for example.

Don’t let the credit card companies play you. Cut off the interest gravy train, and invest that money in yourself.

3. Never miss a payment. One more time for the people in the back: don’t pay this bill late!

Here’s why: most credit cards have rules in there agreement that allow them to trigger a late fee AND a higher interest rate as the penalty for a late payment.

Even if you call and plead your case, nine times out of ten, they won’t reduce your APR. Late payments will cost you money and kill your credit.

4. Know your fees and APR. If you’ve never reviewed your Cardholder Agreement, now is the time to do so. If you tossed them, call the card company and request a copy of it.

These are the rules of the game. The card issuer will refer to these terms if you ever miss a payment or carry a balance. Read that thing!

If you have questions about the conditions, call the company and ask about them. If you’re using credit, you need to know what you’re up against.

5. Review your credit card statement. Every month. One of the easiest way to screw yourself out of money is to ignore your credit card statement.

Make sure your purchases are accurate, and review the interest charges if you have any. Keep an eye out for unexpected fees and unfamiliar charges.

6. Never apply for cards without a strategy. When you’re just starting out, it may be tempting to apply for every card you can think of.

Don’t. App sprees will kill your credit scores.

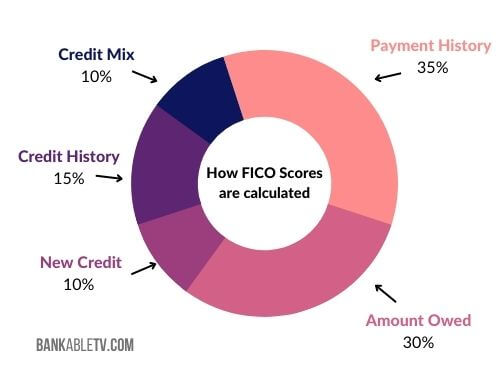

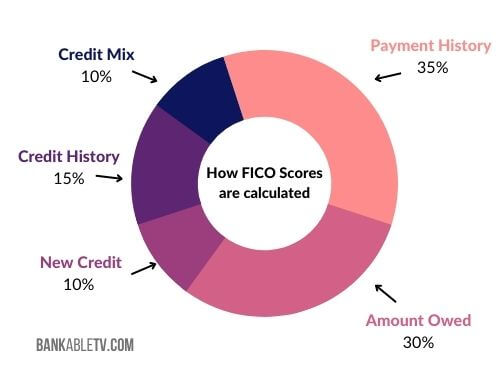

Every time you apply, the credit bureaus record an inquiry on your credit reports, which shaves points off your FICO score. Be strategic, and select credit cards that suit your needs.

If you’re planning a major purchase in the next six month to a year, don’t apply for a new credit card.

7. Don’t close accounts (unless the card absolutely sucks). Here’s the thing. The credit game is rigged.

Your FICO score is based on several different factors, and the average age of your accounts plays a pretty big part in it – a healthy 15%.

By closing an account, you decrease that number, so your score will probably take a hit.

If you carry any other debt, eliminating a credit line will increase your debt-to-credit ratio, which will also result in, say it with me: a hit to your credit score.

Unless the card is predatory (I’m looking at you, Credit One), and costing you a ton in hassle and fees, keep that bad boy open.

8. Never buy anything on credit that you can’t pay for cash. Listen, if you’re trying to maximize your credit score and transform your credit cards into wealth-building tools, be strategic.

Don’t use your cards to increase your lifestyle. Instead, treat them like a debit card – only use as much credit as you can comfortably pay back.

Credit should only be used for purchases you’d otherwise make with cash. As your income and spending grow, so will the credit you use. Always keep Commandment #1 in mind.

9. Use your rewards cards & flourish. While any credit card can be an effective financial tool, nothing beats a strong credit card rewards program.

By using your credit card by like a debit card, you can rack up rewards on autopilot.

If you select great credit cards, it’s easy to get cash back or pay for flights, hotels, and experiences with rewards gained on money you were going to spend anyway.

10. Keep your eye on the big picture. Your credit card strategy can be useful and help you make awesome strides toward your financial goals (great credit, anyone? Hello!), so it’s important to stay focused.

If you’re ever tempted to go on a spending spree or take out costly cash advances, it’s time to step away.

Credit is a wonderful employee, but a horrible boss. Always keep the relationship in check.

Wrapping Up

There are financial gurus out there who preach against using credit under any circumstances.

That advice can work for some people, but it’s pretty outdated.

With the rewards programs, buyer protection, and other amenities modern credit cards offer, it’s hard to deny their value.

If you’re making smart money moves and are confident in your ability to use them wisely, credit cards are an essential part of your financial strategy.

Keep these Commandments in mind, and you’ll be a credit rockstar in no time.

Are you a credit pro? How are you maximizing your cards’ value?