With inflation on the rise at a level rivaling the 1980s, we’re all looking for a way to grow our money with as little stress – and risk – as possible. The hottest ticket to profits at the moment is US Treasury Series I Bonds.

On May 1st, the interest rate of Series I Bonds rose to an unprecedented 9.62%. Since the rate adjusts every six months, bond investors will see their money gain nearly 10% (annualized) between now and October.

For those slightly gun-shy about the volatile stock market, bonds present a way to keep some money working while riding out the dips in other investments.

What is a Series I Bond?

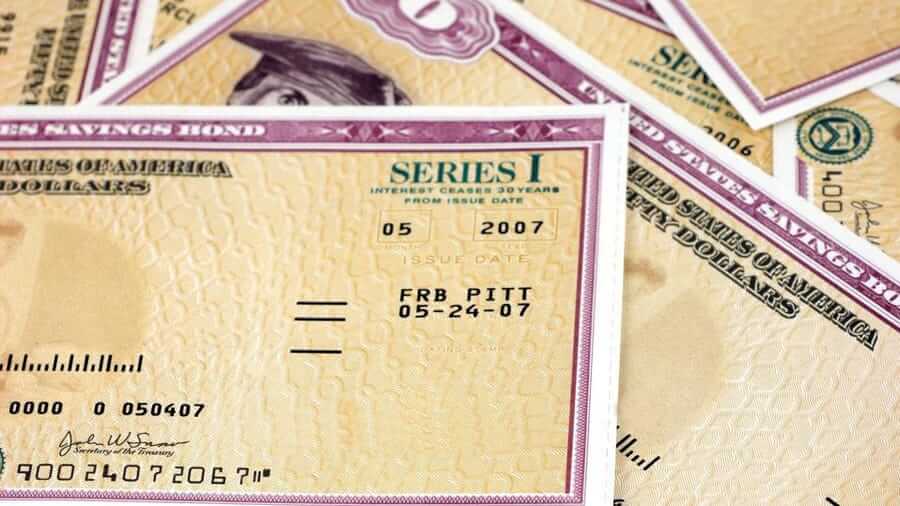

Created in 1998, the Series I bond is an interest-bearing savings bond issued by the US government. It has a maturity date 20 years from the date of purchase, but that can be extended to 30 years.

The amount of interest accrued by a Series I bond is based on two interest rates: a fixed base rate (currently 0%), and a variable rate that adjusts based on inflation every six months.

Bonds can be purchased in increments of $25, and must be held for a minimum of 1 year. You can buy up to $10,000 of Series I bonds each calendar year. If you redeem your bonds between year 1 and year 5, you forfeit the last three months of accrued interest.

What makes Series I Bonds so exciting now?

At nearly 10% interest, newly issued I bonds are one of the most solid bets for those looking to hedge against rapidly rising inflation. If you have several thousand dollars in languishing in your checking account, there’s no denying that I-bonds beat the .5% average interest you’re probably getting there.

In the face of the wide swings the stock market is taking, savings bonds can serve as quite a comfort. Historically, the S&P 500 has returned about 10% a year. If you’ve been watching your portfolio’s steady slide over the past six months – the S&P is down 14% as of May 2022 – I bonds are a low-risk way to keep some of your money growing.

How to Buy Series I Savings Bonds

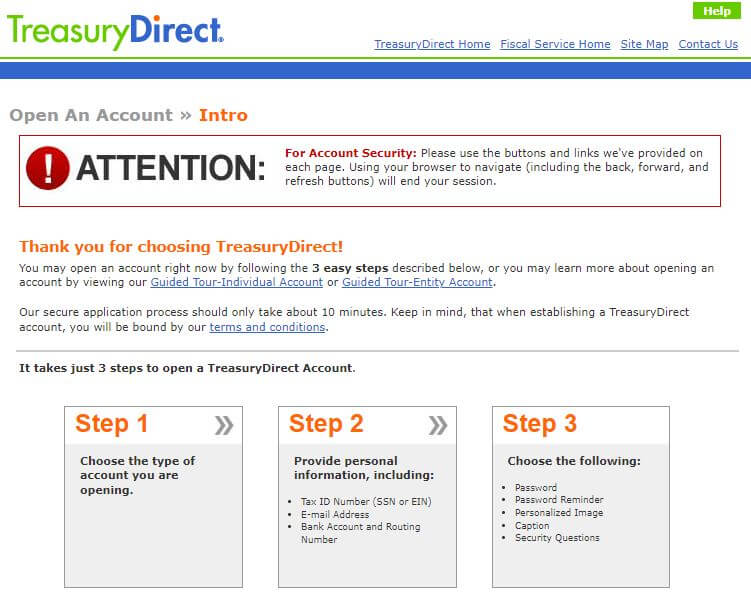

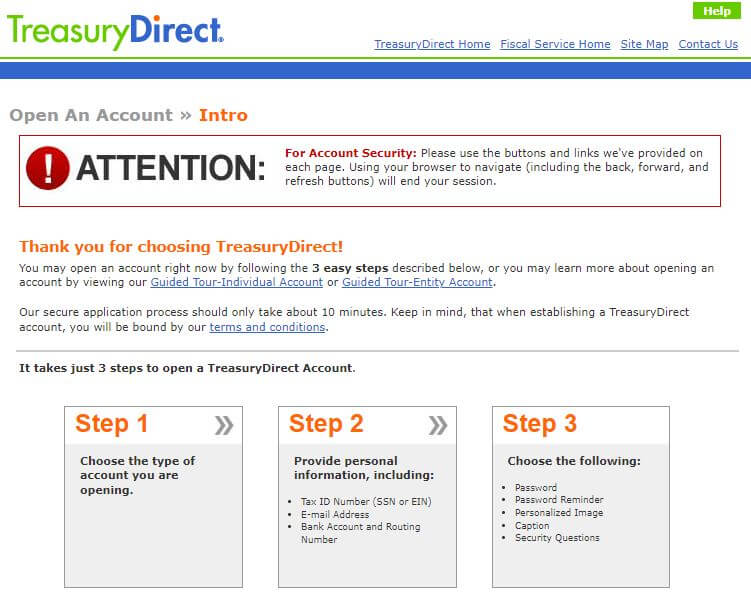

If you’re new to buying savings bonds, getting started is easy. Visit TreasuryDirect.gov and create an account. (Note: You must be a US citizen, resident, or civilian employee of the United States to purchase).

Once your account is active, connect a bank account to make your purchases. Select the amount of bonds you’d like to purchase, and your bank account will be debited the next business day.

If you’re looking for a way to keep your money working in a volatile economy, Series I bonds may be for you. Check out the details and decide if they fit your investment strategy.

Leave a Reply

Want to join the discussion?Feel free to contribute!